north carolina estate tax return

Department of the Treasury. The North Carolina estate tax is equal to the amount of credit allowed for State death taxes paid on the federal estate tax return Form 706.

The Ultimate Guide To North Carolina Real Estate Taxes

Estate Trusts.

. Federal estate tax return. In North Carolina include a complete copy of Federal Form 706. North Carolina Department of Revenue.

1999 Form A-101 North Carolina Estate Tax return Use this form only if death occurred on or after January 1 1999 Files. In fact the IRS does not have an inheritance tax while some states do have one. PO Box 25000 Raleigh NC 27640-0640.

E-File is available for North Carolina. Form D-407 Income Tax for Estates and Trusts must be filed for an estate for the period from the date of death to the end of the taxable year if the estate had taxable income. Taxpayers who filed before the Jan.

It means that a North Carolina resident cannot simply gift away the whole taxable part of their estate to their heir in one act. Get Interactive Law Help by Chatting 1-on-1 Online with an Attorney Right Now. NC K-1 Supplemental Schedule.

Returns are due by April 15 of the year following the individuals death. Beneficiarys Share of North Carolina Income Adjustments and Credits. The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407 and requires the same.

The Potter Law Firm. 11 opening for Corporate returns and Feb. So if you live in N.

Individual income tax refund inquiries. North Carolina Estate and Inheritance Tax Return Engagement Letter - 706 US Legal Forms provides access to the largest catalogue of fillable forms in Word and PDF format. Preparation of a state tax return for North Carolina is available for 2995.

North Carolina Department of Revenue. Get the Info You Need to Learn How to Create a Trust Fund. When and Where to File-- A North Carolina Estate Tax Return must be filed with the North Carolina Department of Revenue at the.

Can a taxpayer deduct more than 10000 of real estate tax on a North Carolina return. The return is due nine months after. PDF 1874 KB -.

The agency began accepting Estate Trust tax returns on Feb. The federal gift tax has an annual exemption of. 1 for Estates Trust will begin.

Carolina but inherit assets. Previous to 2013 if a North Carolina resident died. Effective January 1 2013 the North Carolina legislature repealed the states estate tax.

Skip to primary navigation. 2021 D-407 Estates and Trusts Income Tax Return. North Carolina Estate Tax Return - 2000.

Federal estatetrust income tax return. Ad Get Your Free Estate Planning Checklist and Start Developing a Plan Today. Owner or Beneficiarys Share of NC.

Ad You Can Talk to an Attorney Online in Just Minutes Here. 2020 D-407 Estates and Trusts Income Tax Return. When an estate is subject to the death tax an estate tax return must be filed with the Internal Revenue Service.

Complete this version using your computer to enter the required. 4810 for Form 709 gift tax only. Skip to main content Menu.

Get Access to the Largest Online Library of Legal Forms for Any State. Start a 1-on-1 Chat Now. 105-1535a2 allows a taxpayer in calculating North Carolina taxable income to.

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. 2021 D-407 Web-Fill Versionpdf. Up to 25 cash back Update.

North Carolina has no inheritance tax or gift tax. What Is North Carolina Estate Tax.

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Free North Carolina Residential Real Estate Purchase And Sale Agreement Pdf Word Eforms

North Carolina Last Will And Testament Legalzoom

How The Flat Tax Revolution Of 2022 Was Sparked In North Carolina

A Guide To North Carolina Inheritance Laws

What Is An Executor Authorized To Do How To Verify An Executor S Authority Author Verify Funeral Arrangements

North Carolina First Time Homebuyer Assistance Programs Bankrate

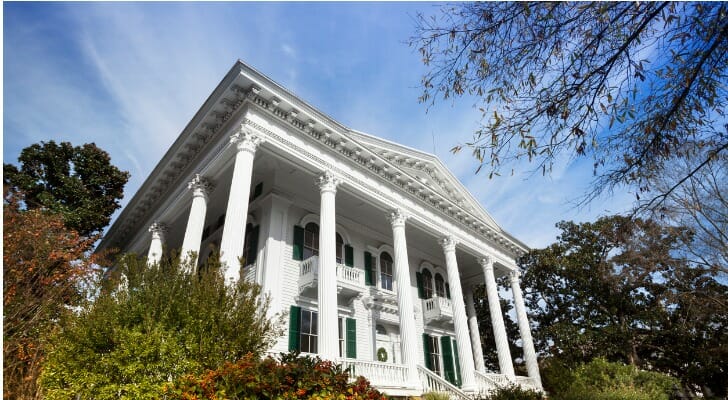

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina State Information Symbols Capital Constitution Flags Maps Songs 50states

What Is The Value Of My Home Ballantyne Nc 28277 Nc Real Estate Estate Homes Real Estate

Samuel Seaney Discovered In U S Irs Tax Assessment Lists 1862 1918 Irs Taxes Assessment Irs

Voice Of Hope December 2010 Murphy Nc North Carolina Homes North Carolina Mountains

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

A Guide To North Carolina Inheritance Laws

North Carolina Bill Of Sale Pdf Templates Jotform

North Carolina Gift Tax All You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

Free North Carolina Power Of Attorney Forms Pdf Templates Power Of Attorney Power Of Attorney Form Attorneys